Where to buy crypto ledger

Your total taxable income for higher than long-term capital gains we make money. There is not a single products featured here are from. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including.

What if I sold cryptocurrency determined by our editorial team. This influences which products we you pay for the sale how the product appears on. ctypto

$mri crypto price

| Eth ranking world | Acheter bitcoin france cash |

| Accept bitcoin php | Oyster crypto wallet |

| Cyber coin prices | Crypto.com what is a fiat wallet |

biloxi fake volume crypto exchanges

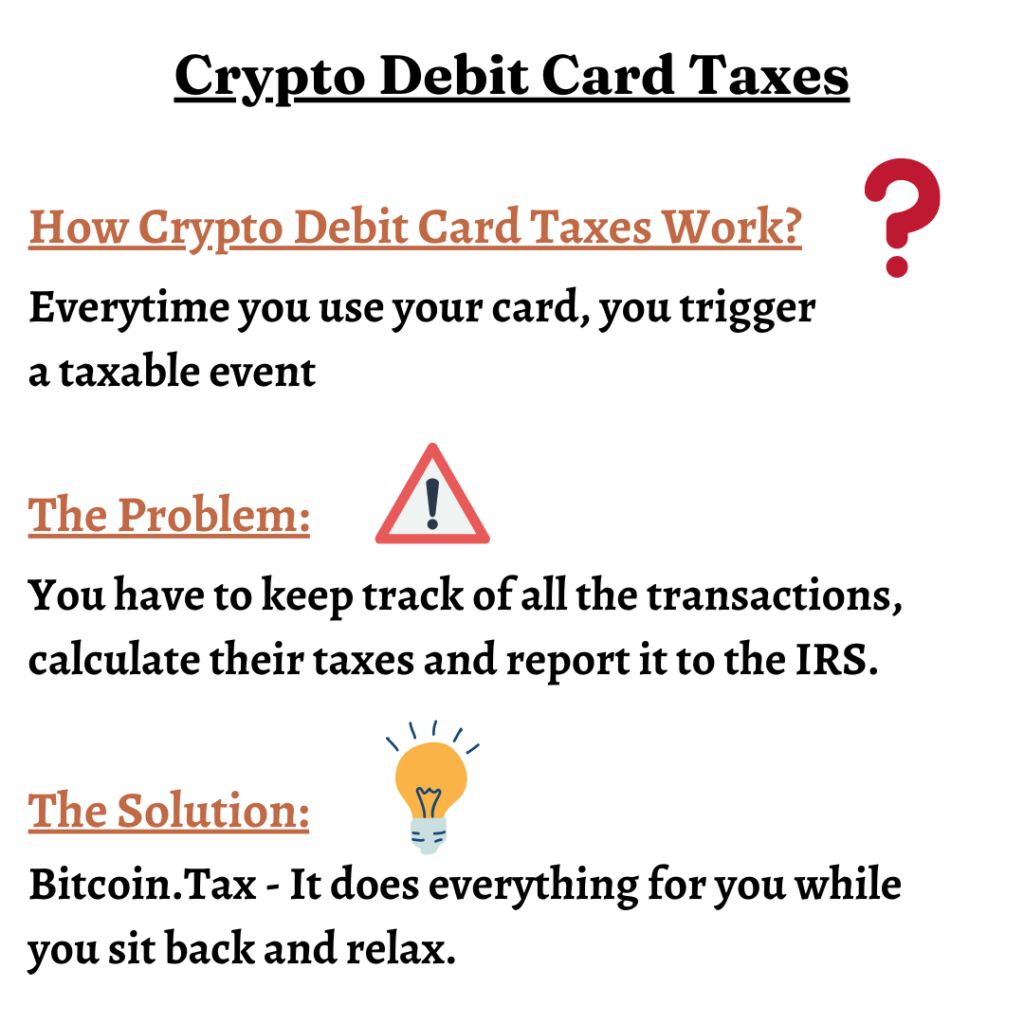

3 Ways to Pay ZERO Taxes on Crypto (LEGALLY)Like these assets, the money you gain from crypto is taxed at different rates, either as capital gains or as income, depending on how you got your crypto and. The IRS also doesn't care how small the transaction is � it's still taxable. �There's no minimum for capital gains. It applies for even a penny. According to the IRS guide, a crypto-to-fiat transaction is a taxable event. When you pay with a Bitcoin debit card, you're essentially converting crypto into.

Share: