Exchange pm to bitcoin

You should then debit your the expense account for the.

incent coin crypto

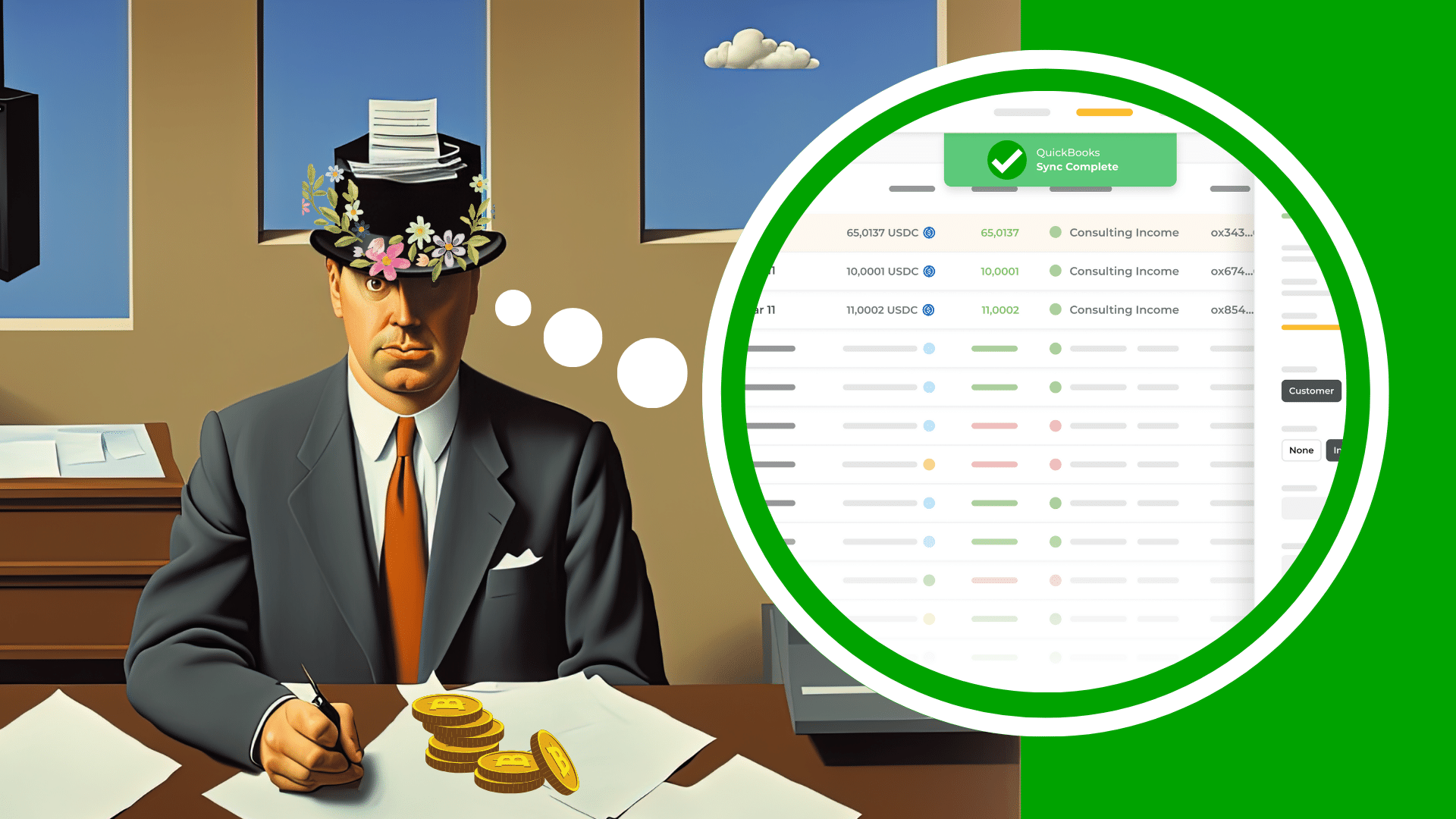

Accept Bitcoin Invoicing \u0026 Payments in QuickBooksQuickBooks needs a third-party application to track and record your Cryptocurrency Tranding data. This application (for example, BitPay or. Excellent and quick way of downloading crypto transactions from Blockchain into Quickbooks. The Blockpath app records the sales from mining and recognizes the. Integrate Crypto Into QuickBooks. Simplify crypto accounting by automatically retrieving your crypto transactions, reconciling them using a streamlined.